Nvidia shares plunge over 10% as DeepSeek shakes up AI Landscape

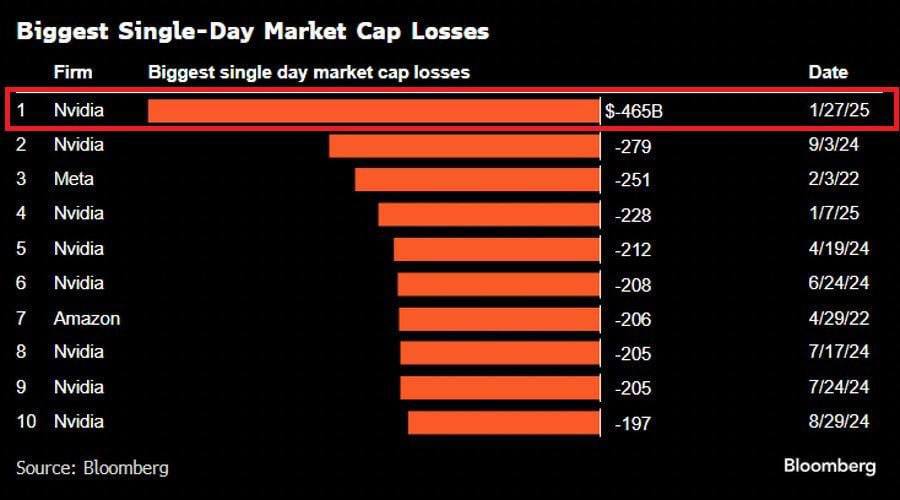

The American chip-maker Nvidia saw its shares plummeting 12% on 27 January 2025, erasing a staggering $465 billion in the company’s market value and marking the stock’s worst single-day drop since the onset of the COVID-19 crisis in March 2020.

The sell-off, which also weighed heavily on the tech-heavy Nasdaq Composite, was triggered by concerns over a new AI model from Chinese start-up DeepSeek, which has cast doubt on the sustainability of massive investments in AI infrastructure by U.S. tech giants.

DeepSeek’s disruptive impact

DeepSeek, a relatively unknown AI lab from China, has sent shockwaves through Silicon Valley with the release of its open-source models, which claim to successfully rival the leading U.S. AI systems like OpenAI’s GPT-4o, Anthropic’s Claude Sonnet 3.5, and Meta’s Llama 3.1. What scares the U.S. AI corporation is that the Chinese app comes at a fraction of the cost borne by them.

DeepSeek’s flagship model, DeepSeek R1, has particularly raised eyebrows, outperforming competitors in third-party benchmark tests across areas such as complex problem-solving, math, and coding.

What makes DeepSeek’s achievements even more remarkable is the resource constraints it faced.

More to read:

Google’s new chip could control all Bitcoin, if it had a quantum computer

The lab reportedly built its models in just two months using Nvidia’s H800 chips - a less powerful alternative to the high-end H100s, which are restricted from export to China due to U.S.

semiconductor sanctions. This has led to speculation that DeepSeek either found a way to circumvent these restrictions or that the export controls are not as effective as Washington had hoped.

The cost of DeepSeek? Just $5.5 million.

Market implications

The release of DeepSeek’s models has sparked a broader debate about the sustainability of the AI arms race, particularly the massive spending by U.S. tech companies on AI infrastructure. Investors may be considering now to review their inflows in AI projects.

More to read:

Apple outshines Amazon as most valuable brand in 2024, Nvidia surpasses BYD as fastest growing

DeepSeek’s rise is part of a broader trend of Chinese companies making significant strides in AI. For instance, Kai-Fu Lee’s startup 01.ai trained its model using just $3 million, while TikTok’s parent company, ByteDance, recently released an update to its AI model that reportedly outperforms OpenAI’s latest offering in key benchmarks.

The sudden drop in Nvidia’s stock price underscores the fragility of the AI market, where even the perception of a technological shift can have outsized impacts. DeepSeek’s emergence as a formidable player in the AI space highlights the growing competition from China and the potential for cost-efficient innovations to disrupt the status quo.

More to read:

E.U. invests €133 million in production of photonic chips

As the AI industry continues to evolve, companies like Nvidia will need to navigate an increasingly complex landscape, where technological advancements and geopolitical tensions intersect. For now, the market remains on edge, waiting to see how this new chapter in the AI race will unfold.

Perplexity CEO Aravind Srinivas summed up the situation aptly: “Necessity is the mother of invention. Because they had to figure out work-arounds, they actually ended up building something a lot more efficient.”

Sources: Investing.com, Tomshardware.com, CNBC

***

NewsCafe is an independent outlet. Our sources of income amount to ads and subscriptions. You can support us via PayPal: office[at]rudeana.com or paypal.me/newscafeeu, or https://buymeacoffee.com/newscafe - any amount is welcome. You may also want to like or share our story, that would help us too.