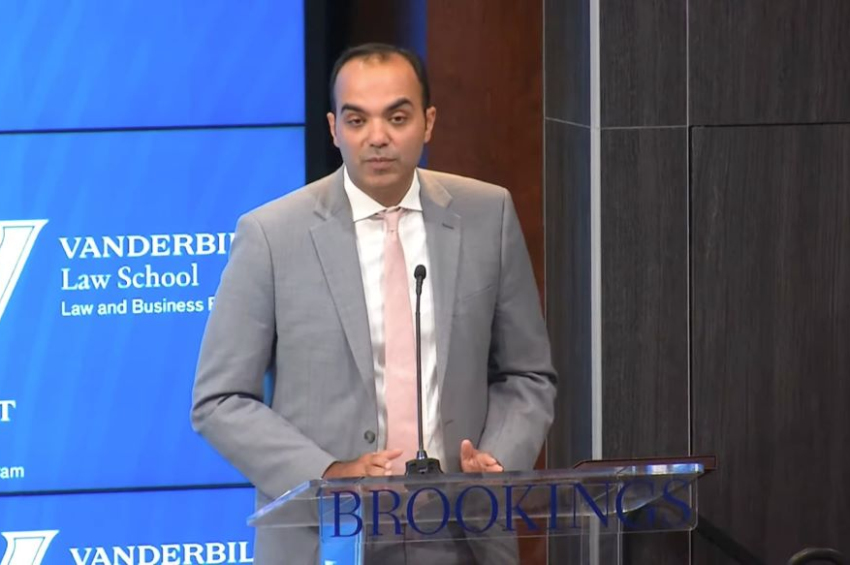

[video] US consumer watchdog considers applying e-banking laws to crypto assets

The director of the US Consumer Financial Protection Bureau (CFPB), Rohit Chopra, has announced plans to provide guidance on how cryptocurrencies might fall under the purview of electronic fund transfer laws.

The CFPB, he told a conference at the Brookings Institution think tank on 6 October, is contemplating the enforcement of the Electronic Fund Transfer Act (EFTA) as a means of shielding consumers from fraudulent cryptocurrency transactions.

The top U.S. agency for safeguarding consumer financial interests seeks to apply the EFTA to private digital dollars and other virtual currencies in order to reduce the harms of errors, hacks and unauthorized transfers.

More to read:

U.S. to impose bank requirements on protocols running crypto operations

Passed in 1978, the EFTA is a federal law that protects consumers when they transfer funds electronically, whether by debit cards, ATMs or bank accounts, and it aims to limit consumer losses from unauthorized transfers.

The EFTA, which is traditionally used in the realm of conventional finance, requires banks and affiliated financial institutions to disclose the extent of their liability before each electronic transaction, shielding consumers from losses incurred during online transactions using methods such as debit cards, ATMs, mobile devices, and other electronic sources.

Chopra also indicated that the agency would scrutinize the role played by non-bank entities in the cryptocurrency market, as some of them provide payment platforms that should offer safety and security.

He proposed that the Treasury's Financial Stability Oversight Council consider designating certain crypto activities as systemically important, thereby equipping relevant parties and agencies with the necessary tools to ensure the stability of stablecoins.

Furthermore, in an effort to collaborate with firms to detect potential fraud, digital asset companies and issuers will be required to furnish specific information regarding their utilization of consumer data and information before launching private cryptocurrencies.

***

Feel free to support our small office: RO50BTRLEURCRT0490900501 (IBAN for Rudeana SRL)

Not feeling like donating? Then click on banners on our website to generate ad revenue. Any help is welcome.