Why Goldman Sachs, Microsoft, Moody's, BNY Mellon and others took part in Canton Network test

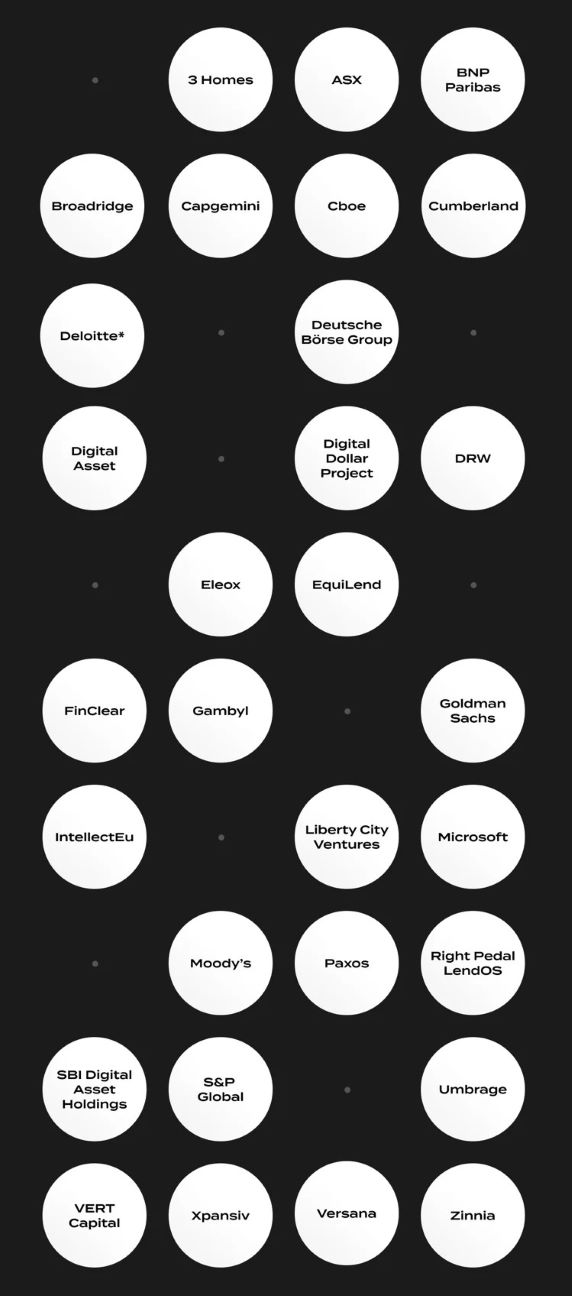

Digital Asset’s Canton Network has completed a monumental blockchain test that marks the beginning of a new era in financial transactions. With participation from a consortium of financial heavyweights including Goldman Sachs, BNY Mellon, DRW, Microsoft, BNP Paribas, Deloitte, Moody’s, and Paxos, the Canton Network showcased the potential of blockchain in transforming the way assets are tokenized and traded.

The Canton pilot allowed 15 asset managers, 13 banks, four custodians and three exchanges to seamlessly transact and settle tokenized assets.

More to read:

Economist who described crypto industry as “total corruption” is launching his own token

This initiative was a collaborative effort involving 155 participants from 45 major organizations. Over a four-day period, in the first decade of March, these participants engaged in simulated transactions across 22 permissioned blockchains connected on the Canton Network. This demonstrated the network's capability to seamlessly settle transactions in real-time while adhering to stringent regulatory requirements.

The pilot encompassed various facets of financial transactions, including asset tokenization, fund registry, digital cash, repo, securities lending, and margin management.

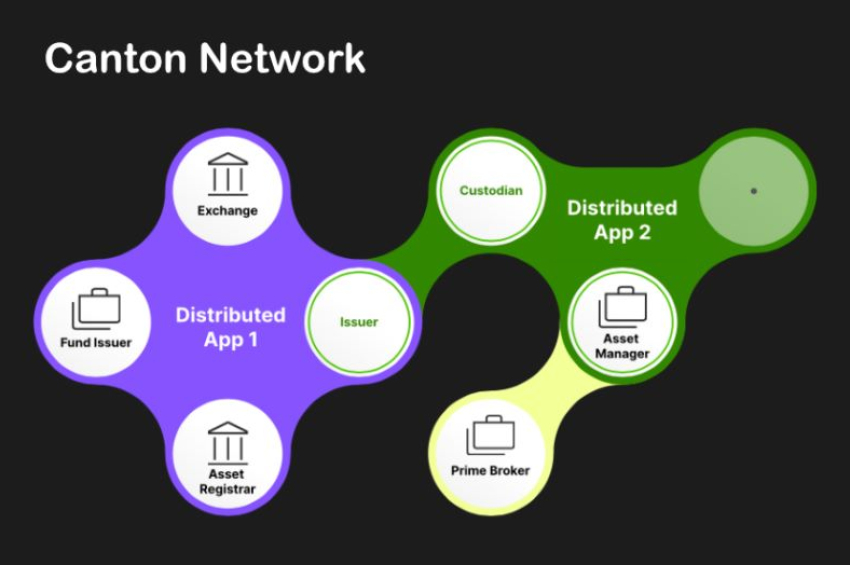

By utilizing distributed ledger applications (dApps) interconnected via the Canton Network TestNet, participants showcased real-time settlement and immediate reconciliation across diverse counterparty systems, a press release specifies.

One of the pivotal aspects highlighted by the pilot was the potential of the Canton Network to mitigate counterparty and settlement risk, optimize capital allocation, and facilitate intraday margin cycles.

By leveraging blockchain technology, participants can unlock efficiencies and streamline processes that were previously cumbersome and prone to errors.

The significance of the Canton Network extends beyond mere technological innovation; it represents a paradigm shift in the way financial systems operate. By enabling interoperability among previously siloed systems, the Canton Network fosters a more connected and synchronized financial ecosystem.

Moreover, the Canton Network prioritizes data privacy and security, crucial considerations in the realm of financial transactions. Its public-permissioned structure strikes a delicate balance between interoperability and privacy controls, ensuring that participants can transact securely while maintaining data confidentiality.

The participants in the test. Credit: Canton Network.

Key industry players such as BNY Mellon, Goldman Sachs, and Paxos provided invaluable expertise throughout the pilot program, underscoring the collaborative nature of this initiative. Their involvement underscores the industry-wide recognition of blockchain's potential to reshape traditional financial processes.

More to read:

Why Ethereum co-founder proposes merging crypto and AI

Digital Asset CEO and Co-Founder Yuval Rooz underlined that the Canton Network marked a significant milestone in the journey towards a more interconnected and regulated financial landscape. By embracing blockchain technology, financial institutions can unlock new opportunities for efficiency, transparency, and security.

The successful completion of the Canton pilot lays the foundation for broader adoption of blockchain in the financial sector. As the industry continues to embrace digital transformation, initiatives like the Canton Network will play a pivotal role in shaping the future of finance.

The Canton Network is the financial industry’s first privacy-enabled interoperable blockchain network designed for institutional assets, launched by Digital Asset with the participation of a group of leading financial institutions, infrastructure providers, technology firms, and consultants in May 2023.

Its design overcomes the shortfalls of existing smart-contract blockchain networks, and enables previously siloed systems in finance to become interoperable and synchronized in ways that had been impossible before, offering privacy and controls required for highly regulated organizations, and creating a safe environment in which assets, data, and cash can move freely across applications in real-time.

Blockchain is a decentralized ledger that keeps transaction records and these ledgers cannot be altered. Bitcoin, Ethereum, and other wide-scale cryptocurrency coins use blockchain to process and record transactions securely.

***

NewsCafe is a small, independent outlet that cares about big issues. Our sources of income amount to ads and donations from readers. You can support us via PayPal: office[at]rudeana.com or paypal.me/newscafeeu. We promise to reward this gesture with more captivating and important topics.