The looming battery mineral supply gap will challenge the clean energy transition

As nations strive to reduce carbon emissions and combat climate change, the transition to clean energy has been heralded as one of the most pressing imperatives of our time.

Electric vehicles (EVs) and energy storage capacities have emerged as a beacon of hope, promising a future of sustainable transportation powered by renewable energy. However, beneath the surface of this narrative lies a significant challenge: the looming supply gap of battery minerals, according to Sprott, a Toronto-based global asset manager providing clients with access to highly-differentiated precious metals and real assets investment strategies.

More to read:

Largest lithium deposit found in the United States

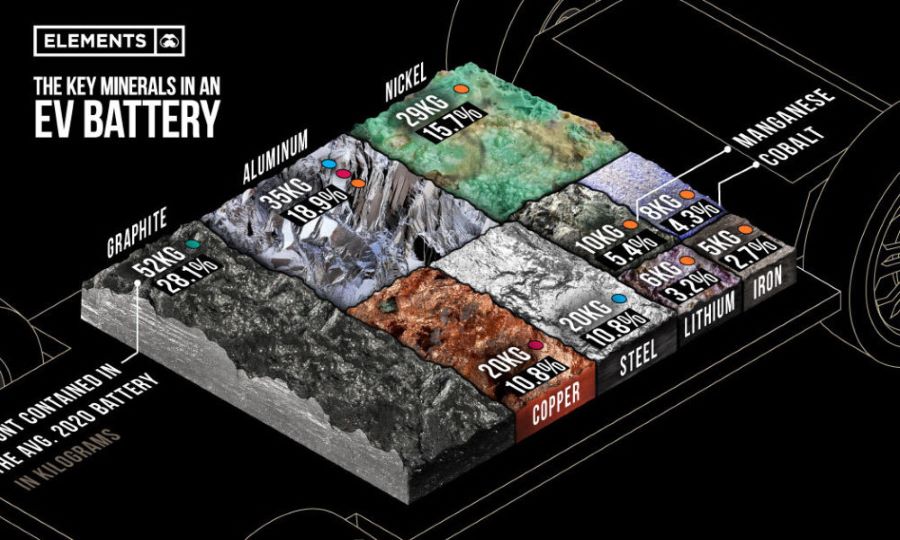

Battery minerals, including copper, cobalt, lithium, nickel, graphite, and manganese, serve as the backbone of modern energy storage systems.

Minerals used in the manufacturing of batteries. Credit: Visualcapitalist

These metals are indispensable for the production of lithium-ion batteries, which power EVs and store renewable energy generated from sources like solar and wind.