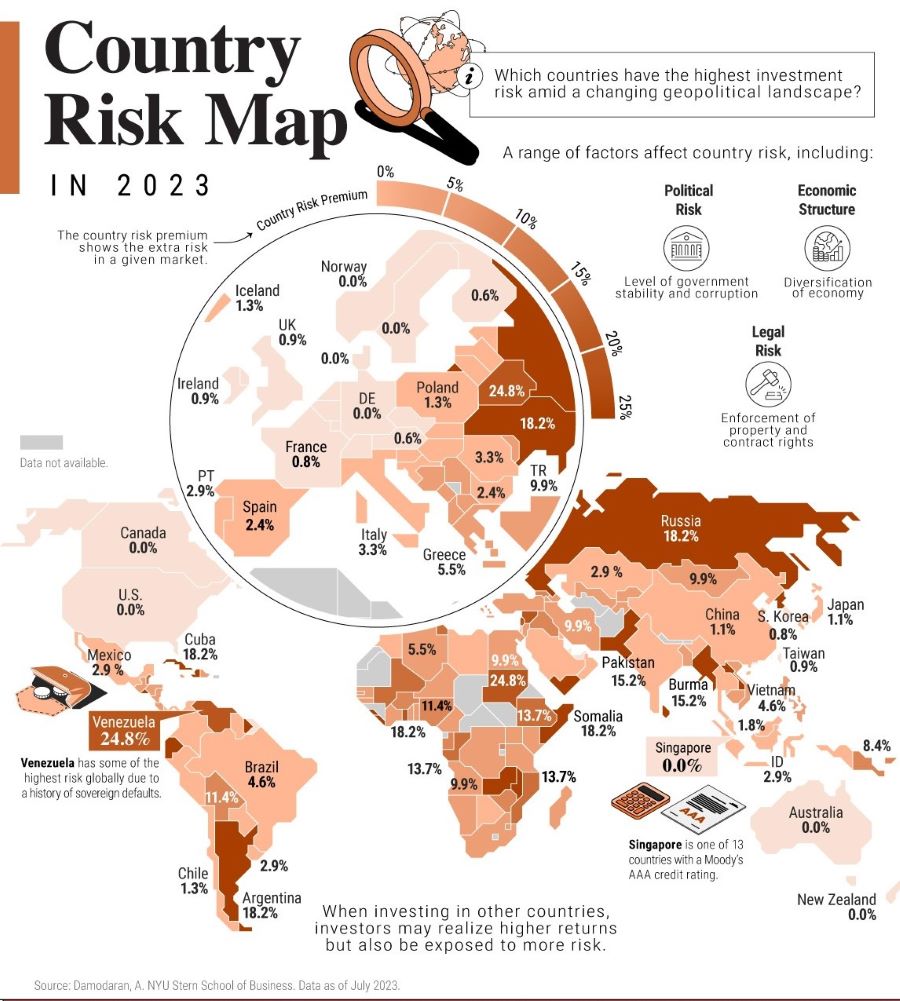

In 2023, Australia was most secure country for investors, Belarus the least

Australia, Canada, and Denmark share the first, second, and third places, respectively, when it comes to assess the investment risk around the world this year. The top ten shortlist that feature 0.0% risks also includes Germany, Liechtenstein, Luxembourg, the Netherlands, New Zealand, Norway, and Singapore.

Other countries with the same score are Sweden, Switzerland, and the United States, according to an analysis published by Aswath Damogaran, professor of finance at at New York University’s Stern School of Business [pictured below].

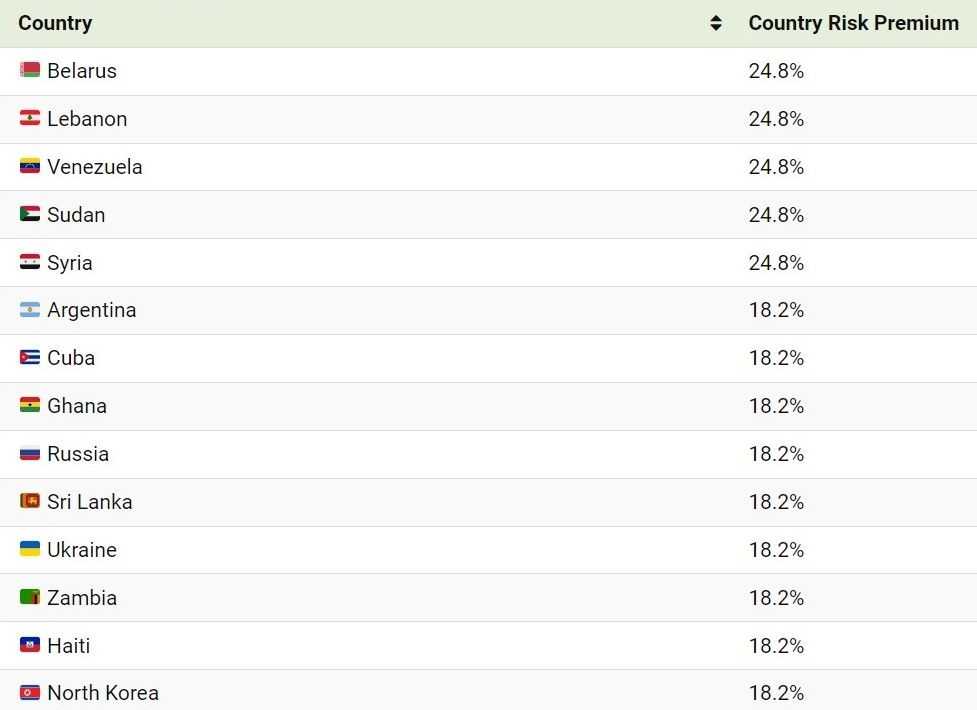

On the opposite side, Belarus, Lebanon, Venezuela, Sudan, Syria, Argentina, Cuba, Ghana, Russia, and Sri Lanka posed the biggest investment risks in 2023. The first five nations share an indicator of 24.8% risk and the last five 18.2%.

Ukraine, which is on the 11th spot, received a rating of 18.2% too, and the devastation brought about by neighboring Russia plays the main role.

How the data was used

Professor Damodaran explained that he often asked his students whether given the rapid growth of emerging economies, and the opportunities this plays to investors, does investment exposure abroad come with risk, and how can that risk be assessed?

He concluded that there were variations in risk across different countries and they can be influenced by geopolitical factors, such as political risk or property rights framework.

The researcher examined the following factors:

- Political risk: Type of regime, corruption, level of conflict

- Legal risk: Property rights protection, contract rights

- Economic risk: Diversification of economy

In addition, he looked at the default risk, which is a common measure used in financial markets. When a nation defaults on its debt, it often leads to market turbulence, and other negative effects that can last for many years.

Together, these factors, along with others, estimate a country risk premium, which is the extra risk in a given market. The U.S. served as baseline for measuring the extra risk of each country, to quote VisualCapitalist, which has dealt with the infographics on this topic.

The countries with the lowest investment risk usually enjoy a AAA rating for government bonds, low or very low corruption, and strong property rights protection. On the opposite end, corruption is rampant, property rights are systematically violated, and the regime is dictatorial or authoritarian.

Worse in some cases, countries with the highest risks for investors are involved in some sort of armed conflict – Russia, for example, wages a war in Ukraine; Syria lies in ruins after a long civil war, and in Sudan it is not over yet; Belarus brutally crashed its civil society after a rigged election; and Venezuela is sinking in hyperinflation after a failed socialist experiment.

More to read:

Financial education guru’s advice: Buy gold, silver and Bitcoin

The author of this analysis notes that the growth of emerging economies presents opportunities for investors, shaped by demographic influences, rising GDP, diversification across sectors, and technological advancements. The financial reward of investing in a country with high risks may be bigger, but exposure to those risks may influence the long-term performance of stocks, bonds, and other financial assets, he stated.

Professor Damodaran updates the analysis on a regular basis, at least two times a year, and shares his ideas on a personal blog.

Here are two lists with best and worst performing nations in terms of investment risks as of July 2023:

***

It's rare to see someone donating to support a science blog [PayPal: @newscafeeu / IBAN - RO50BTRLEURCRT0490900501, Swift - BTRLRO22, Beneficiary - Rudeana SRL]. If you do so - thank you dear reader. Otherwise you may click on ad banners on our website. Any help makes us hopeful.